Why We Built BuyBye (and Why You Might Need It Too)

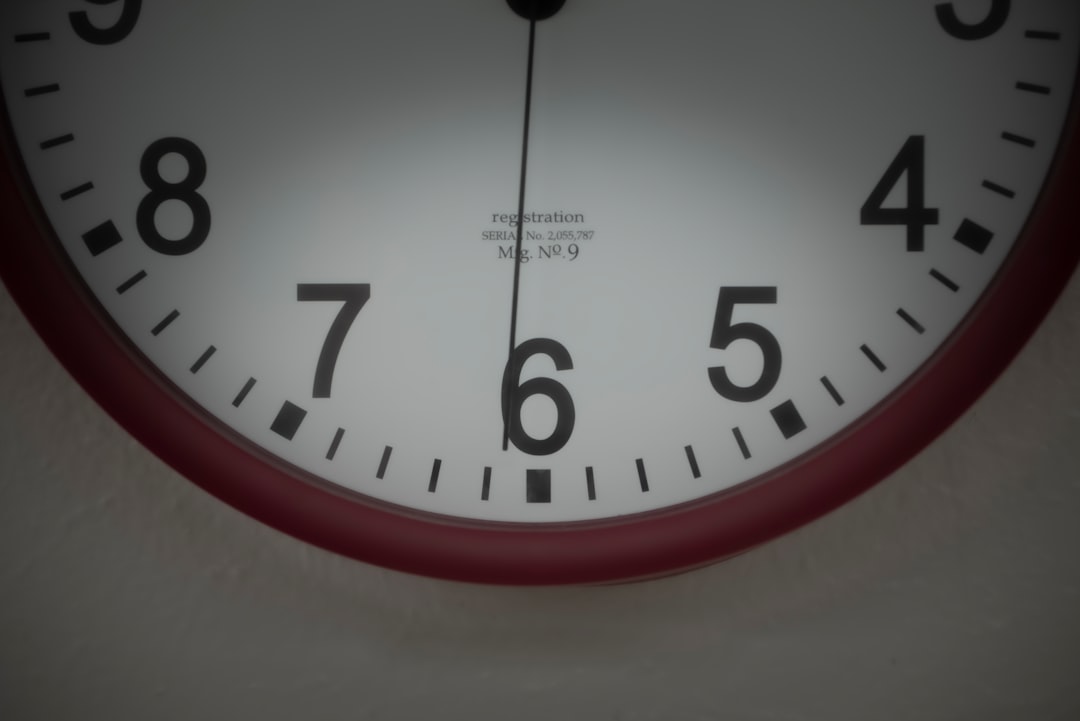

It's 11:47 PM. You're exhausted from work, mindlessly scrolling through your phone while Netflix plays in the background. Suddenly, an ad catches your eye — a gadget you didn't know existed but now absolutely need.

Your thumb hovers over "Buy Now." The dopamine hit is already flowing. In seconds, you've spent $89.99 on something that'll collect dust in a drawer.

Sound familiar? You're not alone. This exact scenario led us to create BuyBye.

The Late-Night Shopping Spiral We All Know

Every night, millions of us fall into the same trap. We're tired, our defenses are down, and suddenly we're buying things we'll regret tomorrow. It's not weakness — it's human nature meeting modern technology.

The numbers are staggering: the average person makes 14 impulse purchases per month, spending over $3,500 annually on items they didn't plan to buy.

For us, it started with a $200 "smart" water bottle that promised to revolutionize hydration. Two weeks later, it was buried under takeout menus, still in its box. That's when we asked ourselves: What if our phones could help us pause before purchasing, instead of pushing us to buy?

That question became BuyBye.

Why Impulse Buying Hits Different Now

Let's be real — shopping has changed. It's no longer just about walking into stores. Today's impulse buying is:

Scientifically Engineered: Companies spend billions studying your behavior, crafting the perfect moment to strike when your willpower is weakest.

Always Available: 24/7 shopping means there's no closing time to save you from yourself. That 2 AM purchase? The algorithms were waiting for it.

Emotionally Targeted: Stressed? Here's retail therapy. Bored? Check out these deals. Algorithms know your emotional state better than you do.

Socially Amplified: Everyone's showing off their latest haul on social media, creating FOMO that turns wants into "needs."

The Hidden Cost of "Just This Once"

We surveyed 500 impulse shoppers and discovered something shocking:

But here's what really got us: 73% said they'd make different choices if they just had a moment to think.

That's all most of us need — a moment. A pause. A friend to ask, "Do you really need this?"

Building a Friend, Not a Judge

The Philosophy

BuyBye isn't about guilt or shame. We've all been there — beating ourselves up after another impulse purchase. That doesn't work, and frankly, it feels terrible.

Instead, we built BuyBye to be the friend who gently asks the right questions at the right time. No judgment, just clarity.

The Approach

We use behavioral psychology and AI to create moments of reflection, not restriction. It's like having a financially savvy friend who knows when to speak up and when to stay quiet.

The goal? Help you align your spending with your actual values and goals.

How BuyBye Actually Works

Smart Questions at the Right Time

When you're about to make a purchase, BuyBye doesn't just say "no." Instead, it asks personalized questions based on your financial situation and goals:

Learning Your Patterns

BuyBye gets smarter over time, learning when you're most vulnerable to impulse buying:

- Late-night scrolling sessions

- Post-payday splurges

- Emotional shopping triggers

- Seasonal spending spikes

Real Stories from Real Users

"I saved $2,400 in three months just by pausing before purchasing. BuyBye helped me realize I was shopping to fill emotional voids, not actual needs."

— Sarah, 29, Marketing Manager

"As someone with ADHD, impulse control is tough. BuyBye gives me that external pause button I desperately needed."

— Marcus, 34, Software Developer

"My credit card debt was spiraling. BuyBye helped me break the cycle without making me feel guilty about every purchase."

— Priya, 41, Teacher

You Might Need BuyBye If:

BuyBye Works Extra Well For:

- People with ADHD: External accountability for impulse control

- Young Professionals: Building healthy financial habits early

- Parents: Modeling smart spending for kids

- Anyone in Debt: Breaking the cycle compassionately

- Mindful Spenders: Aligning purchases with values

Why This Matters More Than Ever

The average American household carries $6,000+ in credit card debt. Gen Z and Millennials report financial stress as their #1 concern. Something needs to change.

BuyBye isn't just about saving money — it's about:

- Mental Health: Reducing the anxiety and shame around money

- Relationships: Fewer fights about spending

- Future Security: Actually reaching those financial goals

- Personal Growth: Understanding yourself better

Every purchase decision is a chance to vote for the life you want. BuyBye helps ensure your votes count.

The Bottom Line

Look, we get it. Changing habits is hard. Fighting against billion-dollar companies designed to make you spend? Even harder.

But you don't have to do it alone. BuyBye is here to help — one purchase decision at a time.

Because at the end of the day, it's not about never buying anything again. It's about buying things that actually add value to your life. Things that future-you will thank present-you for.

Ready to meet that version of yourself?

Our Promise to You

We built BuyBye because we needed it ourselves. We promise to: