FOMO Shopping: How 'Limited Time Offers' Hijack Your Brain (And Your Wallet)

"Only 2 left in stock!" "Sale ends in 4 hours 23 minutes!" "Don't miss out – this deal expires at midnight!"

You've seen it. You've felt it. That sudden rush of panic. Your heart rate picks up. Your palms get sweaty. You think: What if I miss this? What if I never find this deal again? Before you know it, you've clicked "Add to Cart" – not because you really needed the item, but because you couldn't handle the idea of missing out.

That anxiety you felt? It's not an accident. It's a carefully engineered psychological trap that retailers have perfected over decades. And it's costing you thousands of dollars a year. 60% of millennials make purchases within 24 hours due to FOMO. 85% of consumers have purchased something on impulse because a sale was "ending soon." Countdown timers can boost conversions by over 100%.

In this post, we're decoding exactly how FOMO shopping hijacks your brain, revealing the tricks retailers use to manufacture urgency, and showing you how to make rational decisions even when the clock is ticking.

The Neuroscience of FOMO – Why Your Brain Can't Resist

Here's the wild part: FOMO doesn't just feel bad—it activates the same neural pathways as physical pain. Yeah, you read that right. When you see that "Only 2 left!" message, your brain literally processes it like you're about to lose something valuable, triggering the same pain response as stubbing your toe.

Your brain has two systems constantly battling for control: the prefrontal cortex (your rational, logical brain) and the limbic system (your emotional, reward-seeking brain). During FOMO, your emotional system goes into overdrive, flooding your brain with stress hormones that literally impair your ability to think clearly. It's not that you're making a "bad decision"—it's that you're physiologically incapable of making a rational one in that moment.

The dopamine connection is where things get really interesting. You know that excited, buzzy feeling when you see a flash sale? That's dopamine—your brain's reward chemical. But here's the twist: dopamine is released in anticipation of reward, not when you actually get the thing. Flash sales and limited-time offers act as "dopamine stimuli" by creating urgency and novelty. fMRI studies show that just viewing flash sales activates reward circuits in your brain.

Loss aversion makes it even worse. Research shows our brains perceive losses as twice as painful as equivalent gains feel good. So missing a "50% off" deal doesn't feel like missing a gain—it feels like losing money. Your brain registers it as an actual loss, triggering panic and urgent action to "stop the bleeding."

Why It's Especially Powerful Online

The Artificial Scarcity Playbook – How Retailers Engineer Urgency

Let's pull back the curtain. Most of the urgency you feel while shopping online is artificially created using proven psychological tactics—and often, it's not real at all.

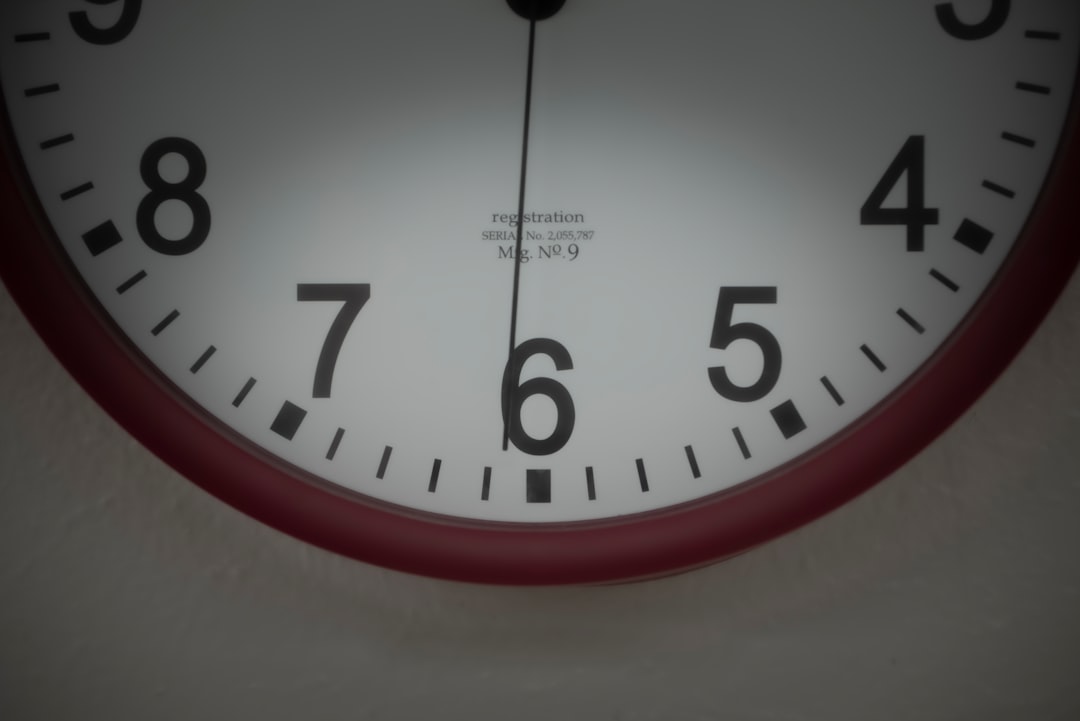

Tactic #1: Countdown Timers

Studies show a 106% increase in awareness of promotions with countdown banners. These timers create time pressure that forces quick decisions by leveraging scarcity principles and triggering FOMO. But here's the dark side: many countdown timers reset or the offer continues after "expiration." 68% of shoppers report feeling annoyed or manipulated by timers that reset. In fact, Canada's Competition Bureau has investigated "fake urgency" as a deceptive practice.

Tactic #2: Low Stock Alerts

"Only 2 left in stock!" sounds urgent, right? It triggers fear of missing out plus a dopamine spike from excitement. But stock levels often don't change—or they're completely inflated. I've personally watched a product show "Only 3 left!" for two weeks straight. Either they're the worst at restocking, or it's manufactured urgency. (Spoiler: it's manufactured urgency.)

Tactic #3: Social Proof + Urgency Combo

"43 people viewing this item right now." "127 purchased in the last 24 hours." This combines FOMO with herd mentality—if everyone else is buying, you don't want to be left out. 84% of consumers trust urgency messages from influencers saying "almost gone." The problem? These numbers are often exaggerated or outright fabricated.

Tactic #4: Flash Sales

"24-hour only!" or "Doorbuster deal – ends 6am!" Research shows scarcity messaging can increase purchase intent by nearly 40%. But plot twist: those same items often return to the "sale price" repeatedly. I've tracked products through three different "flash sales" in a single month. Spoiler alert—it's not that exclusive.

Tactic #5: Tiered Urgency

This one's sneaky. It goes: "Offer expires at midnight" → "Extended for 3 more hours!" → "Final chance!" It creates multiple dopamine hits and multiple purchase opportunities while building a pattern of "I better act now because they mean it this time." Except they never really meant it.

The Real Cost

Let's talk numbers. The average consumer makes impulse purchases worth $150/month—that's $1,800 a year. 40% of all online spending is impulse purchases. And here's the kicker: FOMO-driven purchases often result in buyer's remorse. You know, that package sitting unopened in your closet for six months? Yeah, that one.

Real Deal or Fake Urgency? – The Math Doesn't Lie

Most "limited-time offers" are neither limited nor particularly good offers. Here's how to tell the difference and not get played.

Red Flags for Fake Urgency

The Reset Timer: Countdown that resets every time you visit the site, offers that magically continue after "expiration," or "sale ends soon" with no actual deadline. If you can't pin down when it ends, it's probably not ending.

The Inflated Original Price: "Was $199, now $99!" sounds amazing until you realize it was never sold at $199. Price tracking tools reveal the "sale price" is actually the normal price. Pro tip: if the original price is pre-printed on the tag (not a sticker over the original), that's a red flag.

The Perpetual Shortage: "Only 2 left!" every single time you check over multiple days. If the stock availability never changes, it's artificial scarcity. Vague claims like "selling fast" with no specific numbers? Same deal.

The Meaningless Comparison: "Save 70% off retail price!" But what retail price? Comparisons to MSRP that no retailer actually charges, or "compare at" prices from unknown sources are meaningless. It's like me saying, "This sandwich is 90% off what I arbitrarily decided it's worth!"

How to Evaluate If a Deal Is Actually Good

Strategy #1: Use Price Tracking Tools

CamelCamelCamel, Keepa, and Honey show price history. Check if the price has actually dropped or if it's just the normal price with a fake "sale" banner. Look at price trends over 30-90 days. I once saw a "Black Friday deal" that was literally 50 cents cheaper than the average price over the previous three months.

Strategy #2: Calculate Cost Per Use

Divide the price by the realistic number of times you'll actually use it. $50 shoes you wear 100 times = $0.50 per use (solid deal). $50 kitchen gadget you use twice = $25 per use (terrible deal). Even at 50% off, it's still expensive if you never use it.

Strategy #3: The 10-Minute Analysis Break

The traditional advice is "wait 48 hours before purchasing," but in a world where sales end in hours, that's not realistic. Better approach: take a 10-minute analysis break instead. Remove the item from your cart, close the tab, set a timer for 10 minutes. Use those 10 minutes to research price history and genuinely reflect on whether you need it. If the "urgent" sale is real, it'll still be there in 10 minutes.

Strategy #4: Ask the Disqualifying Questions

Making Rational Decisions Under Pressure

You don't have to fall victim to FOMO. Here are practical strategies to interrupt the urgency loop and make smart decisions even when the clock is ticking.

Interrupt the Dopamine Loop

1. Recognize the physical response: Notice when you feel urgency, anxiety, or excitement. Name it out loud: "This is FOMO, not genuine need." Physical awareness helps activate your rational brain and creates distance from the emotional response.

2. Create productive friction: Remove saved payment methods from sites (adds a 30-second decision buffer where you have to manually enter your card). Require two-step authentication for purchases. Use a shopping list or wishlist instead of immediately adding to cart. These small barriers give your brain time to catch up.

3. Set pre-commitment rules: Decide your rules before you're in the heat of temptation. Examples: "I never buy anything over $50 without sleeping on it." "I always check three other retailers first." "I must explain the purchase out loud to my partner or a friend." Pre-commitment removes the decision-making burden when you're emotionally compromised.

Use AI Analysis as a Circuit Breaker

This is where tools like BuyBye come in clutch. They create a mandatory pause in the impulse cycle by forcing you to articulate why you're buying. BuyBye analyzes whether the purchase fits your budget, goals, and actual needs—providing objective analysis based on your financial reality, not marketing pressure.

The power here is that it's not about willpower. Behavioral economics shows that systems work way better than willpower. When you decide in advance "I'll use BuyBye's analysis before any purchase over $30," you're not fighting your brain chemistry in the moment—you're outsourcing the decision to a system you set up when you were thinking clearly.

Reframe the "Loss"

Here's a mindset shift: You're not "missing out" on the deal. You're choosing financial stability over manufactured urgency. The real loss isn't the discount—it's spending money you don't have on things you don't need. Every time you pass on a fake urgency sale, you're winning, not losing.

When to Actually Act on Time-Limited Offers

If you check all five boxes? Go for it. That's a legitimate deal worth acting on.

The BuyBye Approach – Your FOMO Antidote

BuyBye is designed specifically to help you make rational decisions even when retailers are pressuring you to act fast.

How BuyBye Interrupts the FOMO Cycle

1. Creates a Productive Pause: Instead of going straight from "Want" → "Buy," you insert analysis: "Want" → "Analyze with BuyBye" → "Informed Decision." Just 2-3 minutes of analysis can save hundreds of dollars.

2. Removes Emotion from the Equation: AI analyzes based on YOUR financial reality, not marketing pressure. It looks at your budget, your savings goals, your existing purchases, and provides an objective score: does this make sense for you right now?

3. Checks Your Purchase Against Your Goals: If you're saving for a down payment, BuyBye factors that in. If you've overspent this month, it flags it. It shows trade-offs you might not consider in the moment: "This purchase = 3 extra days until your savings goal."

4. Evaluates Real Value: BuyBye analyzes if the "deal" is actually a good price by considering cost per use, alternatives, and whether you genuinely need it. It flags impulse purchases disguised as "deals."

Real User Scenario

"I was about to buy a $180 'limited time offer' on a coffee maker. I had 3 hours left on the countdown timer—total panic mode. BuyBye's analysis showed: (1) I already owned a coffee maker that I rarely used, (2) The 'sale price' was actually the normal price on two other sites, (3) The $180 would delay my vacation savings goal by two weeks. I didn't buy it. And I've never once regretted that decision." — Sarah, BuyBye user

The Result: Instead of feeling FOMO, you feel confident you made the right choice—whether that's buying or passing.

Conclusion: You Control the Clock, Not the Timer

FOMO is real, powerful, and intentionally engineered by retailers to separate you from your money. Your brain's dopamine response and loss aversion make it genuinely hard to resist. Most urgency is artificial—timers reset, stock levels are inflated, "exclusive sales" run every other week.

But here's the empowering part: now you know the tactics, you can spot them. You don't have to resist FOMO with willpower alone—you can use systems instead. Tools like BuyBye help you make rational decisions even under time pressure, turning manufactured urgency into informed choice.

Next time you see a countdown timer or "only 2 left!" message, pause. Ask yourself: Is this real urgency, or manufactured pressure? Take 10 minutes (or use BuyBye) to evaluate before clicking buy. Remember: Missing a "deal" isn't a loss if it saves you money.

The best deal isn't the one with the biggest discount or the shortest timer—it's the one that genuinely fits your life, your budget, and your goals. And that's not something a countdown timer can tell you.

Ready to break free from FOMO shopping? Try BuyBye's free purchase analysis the next time you feel that urgent pressure to buy. Your future self (and your bank account) will thank you.